As you get ready for tax season, the Pavilion team wants to proactively answer your tax slip questions.

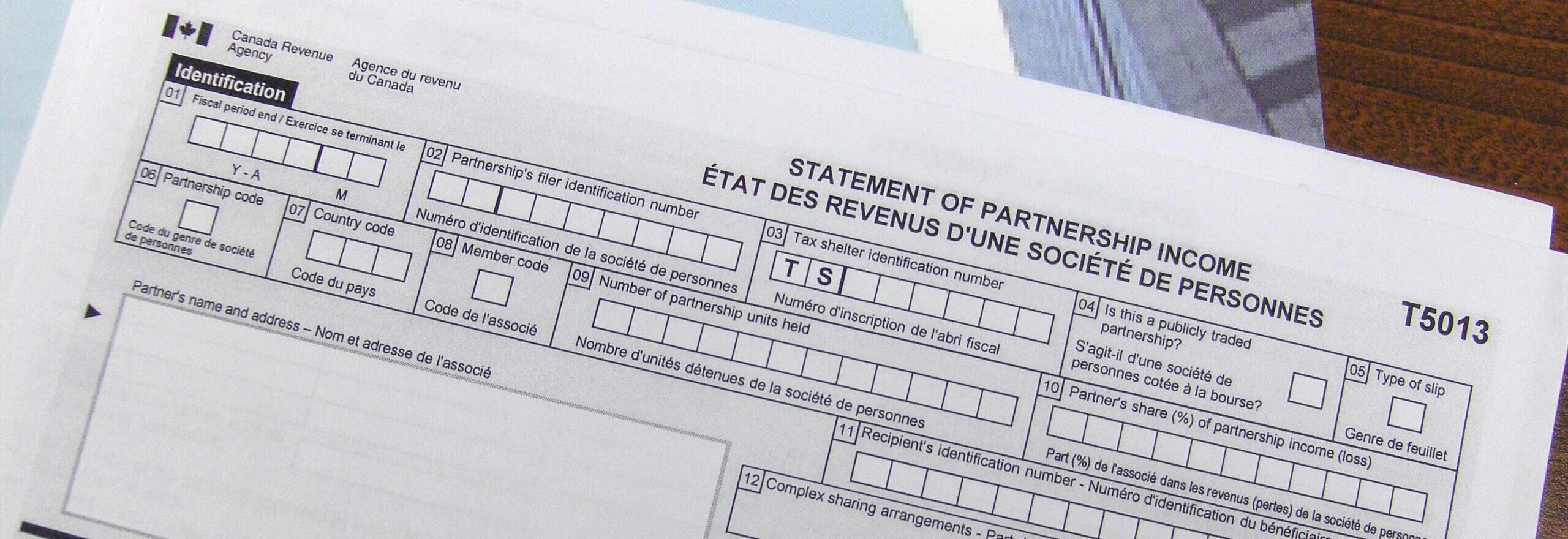

“WHEN CAN I EXPECT MY PAVILION TAX SLIPS?”

The timing is dictated by the workflow of preparing the tax slips. Several things need to occur before a tax slip can be produced. There are three major components. After the year end, we begin preparing the financial statements and associated files for the arrival of the fund auditors.

1. The fund auditors begin their auditing the second week of February and it is generally completed by the beginning of March.

2. At the conclusion of the audit, the financial statements and files can then be used to create the tax information returns for the partnerships, upon which the individual tax slips are based.

3. With some additional time for quality assurance this brings the expected timeline to the end of March.

All tax slips are then uploaded to each client’s portal starting the first week of April.

Clients receive notifications from our portal system when this is complete.

“DO YOU HAVE ANY OTHER TAX FILING RESOURCES AVAILABLE?”

Our tax filing guide will be ready soon to help answer the rest of your tax filing questions.